How the top 50 Online Exporters in the CEE region perform? - report by Growww Digital The "Top 50 Online Exporters in the CEE Region" report by Growww Digital analyzes the performance of e-commerce exporters in Central and Eastern Europe. While the sector experienced...

2026 E-kereskedelmi Trendjei Webinár

Vonjuk le együtt 2025 tanulságait, hogy felkészülten vághassunk bele az idei év kihívásaiba!

A Digitális Kereskedelmi Szövetség az Ecommerce Expo főszervezőivel közös évindító webinárt szervez a nemzetközi piacokat meghódítani vágyó magyar e-kereskedők számára.

A Digitális Kereskedelmi Szövetség az Ecommerce Expo főszervezőivel közös évindító webinárt szervez a nemzetközi piacokat meghódítani vágyó magyar e-kereskedők számára.

A PwC legfrissebb – a DKSZ szakmai támogatásával megjelenő – e-kereskedelmi kutatására építve áttekintjük, mi mozgatta igazán a piacot 2025-ben, és milyen irányok rajzolódnak ki 2026-ra.

Miről lesz szó a webináron?

- Karácsonyi szezon 2025: Mi működött, mi változott a vásárlói viselkedésben, melyek voltak a nyertes csatornák?

- 2025 legerősebb trendjei: Mit érdemes megtartani, és mit kell újragondolni?

- Marketplace helyzetkép: Szereplők, erőviszonyok, stratégiai dilemmák.

- Temu és a verseny új szabályai: Hatás a keresletre, az árérzékenységre, a márkákra és a kosárértékre.

- PPC és nemzetközi kitekintés: Gyakorlati tanulságok kampányoldalról, tipikus buktatók és gyors nyereségek.

- 2026-os előrejelzések: Milyen e-kereskedelmi tendenciák várhatók, mire érdemes felkészülni már most?

A beszélgetést vezeti Guba Vanda (Ecommerce Expo), beszélgetőpartnerei a DKSZ elnökségéből:

🎙️Madar Norbert (a DKSZ alelnöke, a PwC Magyarország digitális kereskedelmi tanácsadási csapatának vezetője)

🎙️ Szabó László (a DKSZ elnökségi tagja, a Growww Digital alapító partnere)

A DKSZ az Ecommerce Expo szervezőivel közösen idén is aktívan formálja a szakmai párbeszédet: először online, majd februárban élőben az Ecommerce Expo Budapesten, és annak exkluzív előeseményén, a Go Global Forumon, ahol a nemzetközi terjeszkedés, gyakorlati példák és személyes szakmai találkozások kerülnek fókuszba.

🎟️Extra: a DKSZ2026 kuponkóddal most 20% kedvezménnyel vehetsz részt a konferencián!

Top 50 CEE Online Exporters 2024

Digitális Kereskedelmi Körkép 2024/II.

A hazai e-kereskedelmi piac 2024-ben olyan átalakuláson ment keresztül, amelyre 25 éves fennállása óta még nem volt példa 2024-ben a teljes magyar e-kereskedelmi piac a PwC Q1-Q3 közötti mérései és Q4-re vonatkozó előzetes adatai alapján 15%-os árbevétel-növekedés...

Új lendület a digitális kereskedelemben

Megújult a Digitális Kereskedelmi Szövetség vezetősége Az átalakulás célja, hogy a szövetség hatékonyabban reagáljon a digitális kereskedelem előtt álló kihívásokra, elősegítse a hazai szereplők megerősödését és az exporttevékenység fellendülését. A Szövetség...

2026 E-kereskedelmi Trendjei Webinár

Vonjuk le együtt 2025 tanulságait, hogy felkészülten vághassunk bele az idei év kihívásaiba! A Digitális Kereskedelmi Szövetség az Ecommerce Expo főszervezőivel közös évindító webinárt szervez a nemzetközi piacokat meghódítani vágyó magyar e-kereskedők számára. A...

Omnichannel kereskedelmi menedzsment képzés indul

A Budapesti Corvinus Egyetem elindítja az ország első Omnichannel kereskedelmi menedzsment executive képzését Hazánkban elsőként – az OANDER Technologies Kft. partnerségével – indul képzési program omnichannel témakörben, amely valódi, „boardroom-ready” tudást ad a...

Digitális Kereskedelmi Körkép 2025/II.

A globálisok árnyékában a vásárlói élményért folyik a verseny az e-kereskedelemben A magyar online kereskedelmi piacot 2025-ben letarolták a globális szereplők: a főleg Kínából érkező import rendelések aránya - köszönhetően a 20-22%-os éves növekedési ütemnek - a...

NGM és VOSZ együttműködés

Együttműködési megállapodás a digitális kereskedelem biztonságáért A Nemzetgazdasági Minisztérium (NGM) és a Vállalkozók és Munkáltatók Országos Szövetsége (VOSZ) együttműködési szerződést írt alá, amely a magyar digitális gazdaság fejlesztését szolgálja. A...

Rekorddöntő Black Friday

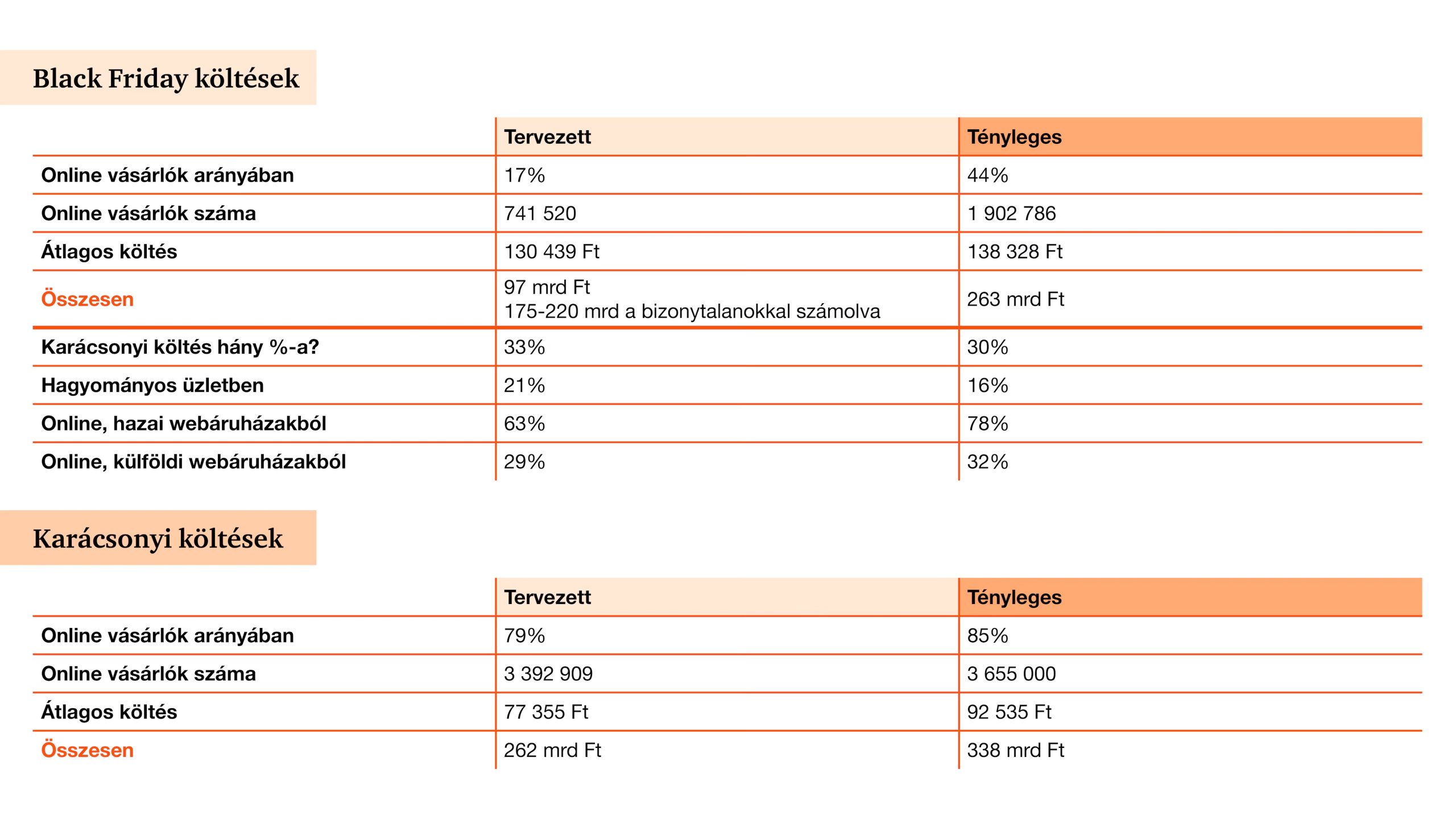

Az akciók ereje: Hogyan lett a bizonytalanságból rekordköltés? A magyarok idén bátrabban nyúltak a pénztárcájukhoz: a Black Friday és a karácsonyi vásárlási szezon a visszafogott előzetes becsléseket jóval túlszárnyalta, és a költések volumene elérte a 260 milliárd...

PwC karácsonyi kutatás 2025

Mennyit költünk idén karácsonyra? Rekordösszegek és új vásárlói szokások az idei Black Friday-en A korábbi évekkel ellentétben a Black Friday már nem csak egyetlen novemberi napból áll, hanem egy több napon-héten át tartó akciósorozattal bombázzák a fogyasztókat. A...