How the top 50 Online Exporters in the CEE region perform? - report by Growww Digital The "Top 50 Online Exporters in the CEE Region" report by Growww Digital analyzes the performance of e-commerce exporters in Central and Eastern Europe. While the sector experienced...

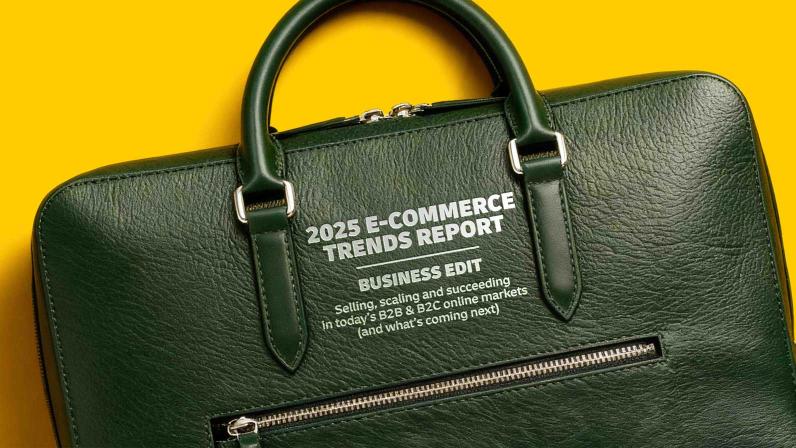

DHL 2025 E-Commerce Trends Reports

DHL unveils first global e-commerce business report: AI, social commerce & sustainability lead 2025 trends

The report offers an exclusive look at how companies are selling, scaling, and succeeding in today’s rapidly evolving digital landscape, driven by omnichannel strategies, AI-powered personalization, cross-border expansion, and a growing emphasis on sustainability and logistics excellence.

- 4,050 E-Commerce businesses across 19 global markets were surveyed to find out how they are selling, scaling and succeeding in today’s online markets

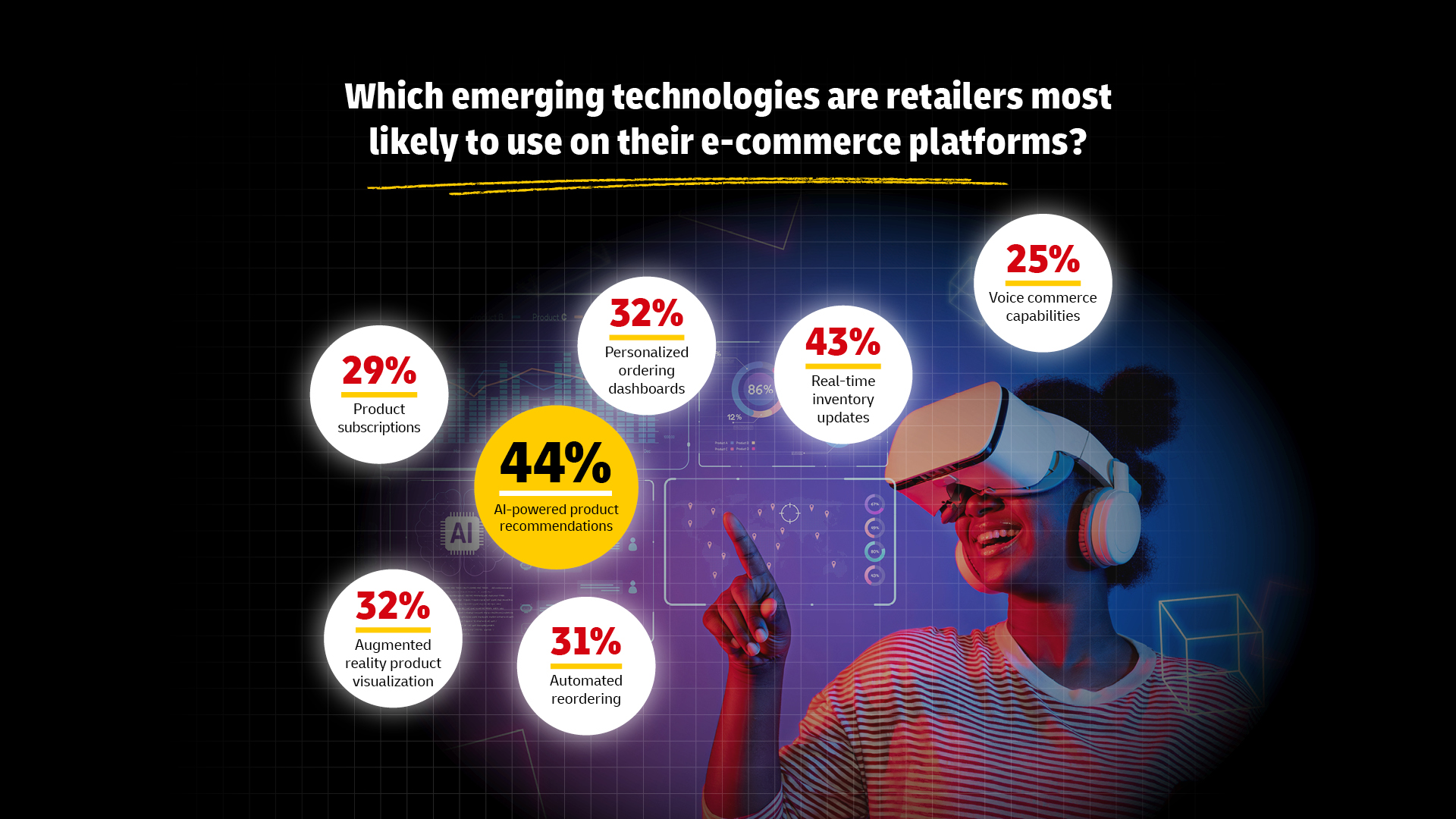

- AI adoption is gaining momentum with almost half of the companies integrating artificial intelligence into their operations. Among B2B e-tailers, usage is even higher at 61%, with key applications including personalization, content generation, and customer service

- Social commerce surges: 87% of businesses have a social media presence with TikTok & Instagram leading the way. 76% of e-tailers expect social sales to grow in the next five years

- Sustainability becomes essential: 85% of businesses say sustainability is important, with many retailers cutting plastic, reselling, and going circular.

DHL eCommerce launched the first “Business Edition” in its series of 2025 ECommerce Trends Reports – a landmark study capturing the voices of 4,050 e-commerce businesses across Europe, the Americas, and Asia Pacific. The report offers an exclusive look at how companies are selling, scaling, and succeeding in today’s rapidly evolving digital landscape, driven by omnichannel strategies, AI-powered personalization, cross-border expansion, and a growing emphasis on sustainability and logistics excellence.

„This report offers a powerful snapshot of how e-commerce is evolving – from AI-driven personalization and social commerce to the rise of B2B and borderless trade. It’s not just about trends; it’s about transformation and the heartbeat of local and global e-commerce”

– Pablo Ciano, CEO of DHL eCommerce, said.

“Businesses are scaling faster, selling smarter, and prioritizing sustainability like never before. At DHL, we’re proud to support this momentum, helping retailers deliver with speed, trust, and responsibility in every market they serve.”

With Black Friday around the corner and global e-commerce growth accelerating, DHL’s new report offers insights into how businesses are preparing for peak season and beyond. Whether B2B or B2C, businesses are investing in speed, trust, and personalization to win in a crowded marketplace. The Business Report covers a range of different topics that provide actionable insights to e-commerce businesses of all sizes.

Further key findings:

- Logistics is the hidden hero of the checkout – 96% of retailers say their logistics offering is key to securing sales, and 86% say free delivery and returns improve sales.

- B2B retailers and the rules of online selling – With 78% of B2B retailers expecting website sales to grow and 61% already using AI across their platforms, the B2B e-commerce landscape is rapidly evolving to mirror the speed, personalization and innovation of consumer shopping.

- In 2025, e-commerce success means selling everywhere – because with 63% of retailers selling on three or more platforms, 68% on Amazon, and 87% active on social media, if online businesses are not where their customers are, they’re nowhere.

- Borderless commerce is booming – 64% of e-commerce retailers now sell internationally – rising to 88% for large businesses and 85% of medium-sized ones and they’re streamlining cross-border trade by registering for IOSS (Import One-Stop Shop) and securing EORI (Economic Operators Registration and Identification) numbers – while over half opt for DDP (Delivered Duty Paid) incoterms to simplify delivery and duty handling.

- Generational shifts – Gen Z and Millennials dominate weekly online purchases, while Gen Alpha is emerging as a new influence on household buying.

- Subscriptions reshape loyalty – 52% of businesses offer product subscriptions, and 14% offer delivery and returns subscriptions.

- Black Friday remains critical – 84% of retailers will participate in 2025, with 60% reporting increased sales year-over-year. However, it’s micro businesses and sole traders revealing more modest results with only 48% seeing increased sales.

- Out-of-home delivery locations essential for big business & practical for smaller players – 96% of large and medium e-commerce retailers say they’re key to driving sales and repeat business, while 53% of sole traders rely on them the most for sending parcels.

Top 50 CEE Online Exporters 2024

Digitális Kereskedelmi Körkép 2024/II.

A hazai e-kereskedelmi piac 2024-ben olyan átalakuláson ment keresztül, amelyre 25 éves fennállása óta még nem volt példa 2024-ben a teljes magyar e-kereskedelmi piac a PwC Q1-Q3 közötti mérései és Q4-re vonatkozó előzetes adatai alapján 15%-os árbevétel-növekedés...

Új lendület a digitális kereskedelemben

Megújult a Digitális Kereskedelmi Szövetség vezetősége Az átalakulás célja, hogy a szövetség hatékonyabban reagáljon a digitális kereskedelem előtt álló kihívásokra, elősegítse a hazai szereplők megerősödését és az exporttevékenység fellendülését. A Szövetség...

2026 E-kereskedelmi Trendjei Webinár

Vonjuk le együtt 2025 tanulságait, hogy felkészülten vághassunk bele az idei év kihívásaiba! A Digitális Kereskedelmi Szövetség az Ecommerce Expo főszervezőivel közös évindító webinárt szervez a nemzetközi piacokat meghódítani vágyó magyar e-kereskedők számára. A...

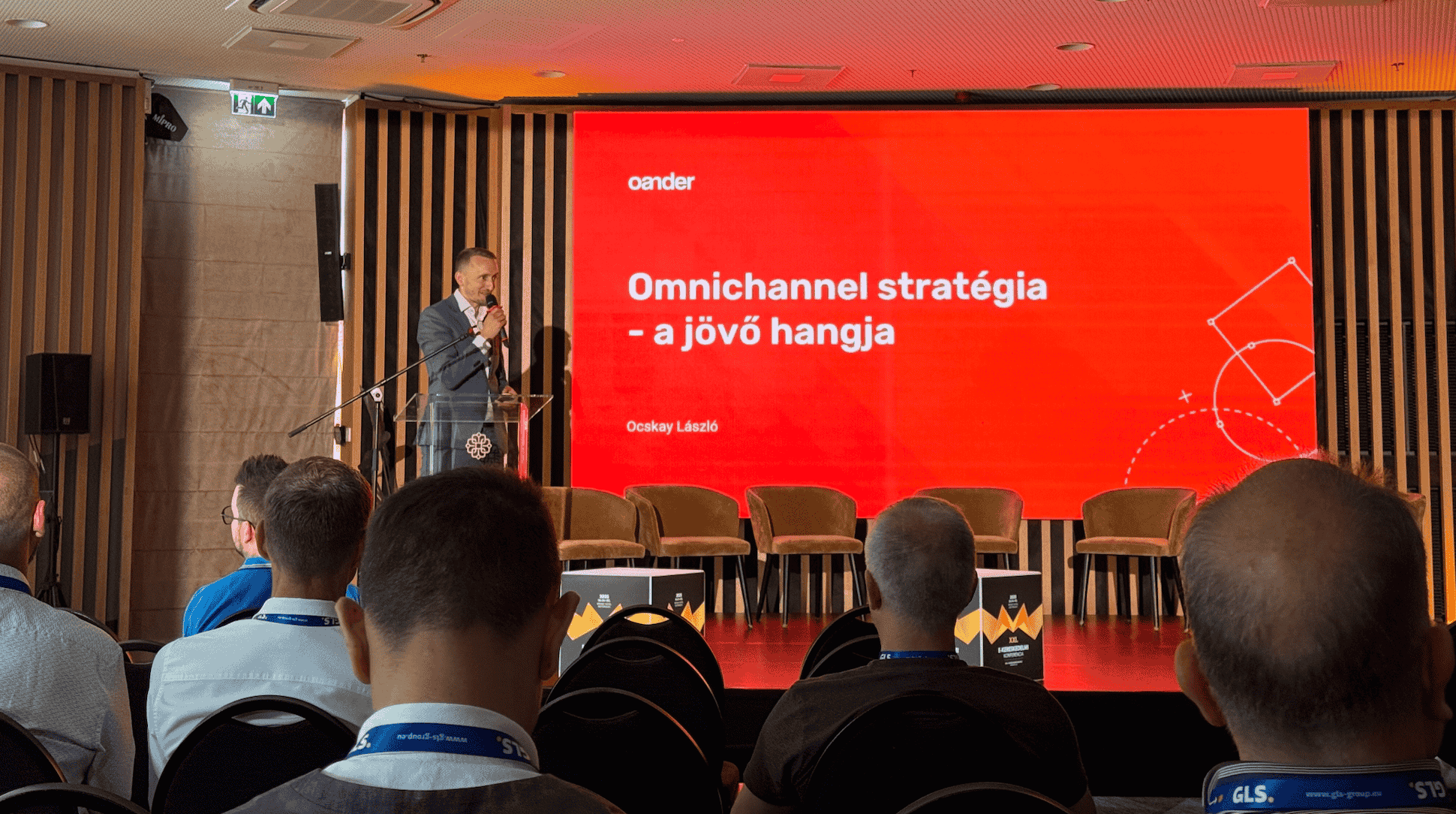

Omnichannel kereskedelmi menedzsment képzés indul

A Budapesti Corvinus Egyetem elindítja az ország első Omnichannel kereskedelmi menedzsment executive képzését Hazánkban elsőként – az OANDER Technologies Kft. partnerségével – indul képzési program omnichannel témakörben, amely valódi, „boardroom-ready” tudást ad a...

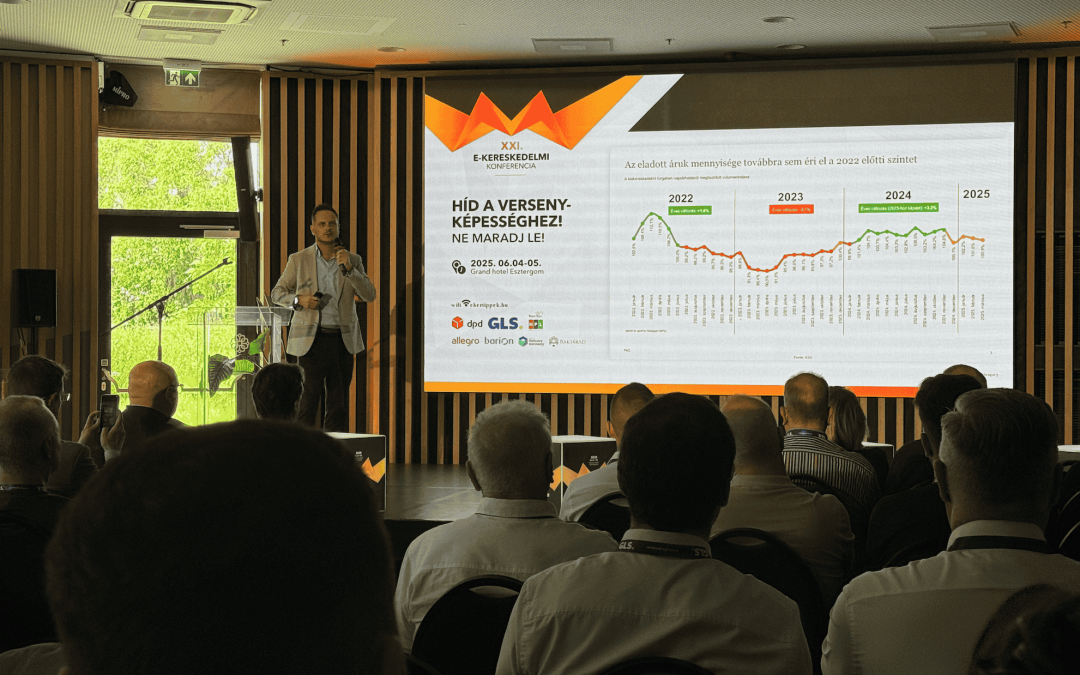

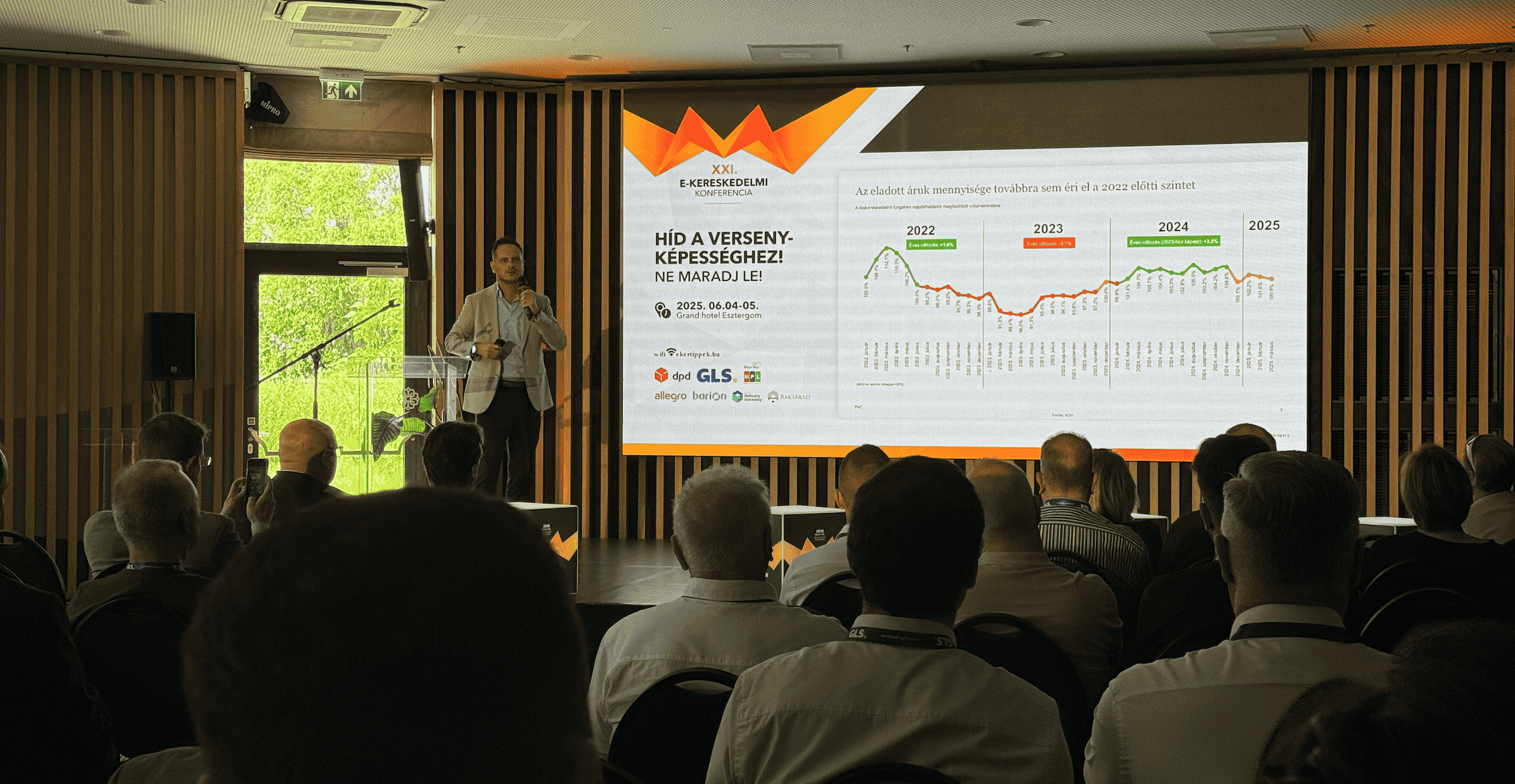

Digitális Kereskedelmi Körkép 2025/II.

A globálisok árnyékában a vásárlói élményért folyik a verseny az e-kereskedelemben A magyar online kereskedelmi piacot 2025-ben letarolták a globális szereplők: a főleg Kínából érkező import rendelések aránya - köszönhetően a 20-22%-os éves növekedési ütemnek - a...

NGM és VOSZ együttműködés

Együttműködési megállapodás a digitális kereskedelem biztonságáért A Nemzetgazdasági Minisztérium (NGM) és a Vállalkozók és Munkáltatók Országos Szövetsége (VOSZ) együttműködési szerződést írt alá, amely a magyar digitális gazdaság fejlesztését szolgálja. A...

Rekorddöntő Black Friday

Az akciók ereje: Hogyan lett a bizonytalanságból rekordköltés? A magyarok idén bátrabban nyúltak a pénztárcájukhoz: a Black Friday és a karácsonyi vásárlási szezon a visszafogott előzetes becsléseket jóval túlszárnyalta, és a költések volumene elérte a 260 milliárd...

PwC karácsonyi kutatás 2025

Mennyit költünk idén karácsonyra? Rekordösszegek és új vásárlói szokások az idei Black Friday-en A korábbi évekkel ellentétben a Black Friday már nem csak egyetlen novemberi napból áll, hanem egy több napon-héten át tartó akciósorozattal bombázzák a fogyasztókat. A...